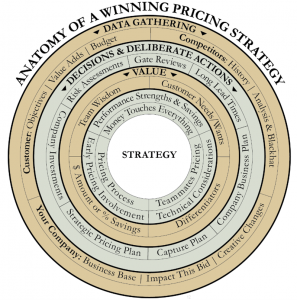

While strategic pricing is important to the success of every bid, the process of data gathering cannot be missed or understated. It is significant. Data gathering is a continuous activity in every stage of the bid. The three major components of data gathering as depicted in the visual below, when taken in their parts as well as how they interrelate, will give a Government contractor the information they need to compose their pricing strategy. Data gathering is in the outermost ring. It is the foundation behind the structure you are building.

The Anatomy of Strategic Pricing® is Comprehensive

The anatomy of strategic pricing is a complex and complete view of your decisions and deliberate actions, the data you want to amass, and the important merits and value advantages you will need to arrive at a riveting price response. It is comprehensive. Strategic pricing is an all-inclusive route that gets to a winning price.

Customer Insight

What you know about your customer, their needs, their valuable must-haves, and their price sensitivity, will tell you volumes about how to construct your approach to the price. Period. Your success depends upon your knowledge of these elements. While most Government contractors are fairly good at getting information about the technical needs, they typically lack information related to the price needs, must-haves, and sensitivity. When you have this type of conversation with your customers, you know how to pitch to them. It forms the basis for your strategic pricing. Without it, why bid it?

Competition Information

We cannot say enough about getting information about your competitors. Derive as much information as you can from public sources. Get competitors’ previous contracts with this customer, GSA schedule information, recent winning pricing data, and teammates’ knowledge of the competition. The most revealing data may come from GAO protest information and the competitors’ pricing style. They often tell you what pricing approach your competition has been taking lately. One important aspect of pricing is the written narrative and how you can ghost what your competitors have been doing to cut prices unrealistically. Do they bid too low unrealistic salaries or are they using outdated or undocumented escalation rates? Dig into the protests and find out where their weaknesses have been. Especially if what you are bidding on is a cost-type contract, you will get big mileage out of describing how unrealistic their numbers are if you uncover that in their history.

Company View

It is vital to look at your company when you are preparing to bid on each opportunity. What would you look for? The risks associated with winning this award. Any investments you need to make to prepare, staff, and run the project. How soon you need to make major decisions, what they are, and if you need to order long lead items. Considerations for any new indirect pools. Whether you need to hire new talent vs. using existing talent. Assess your historical past performance statistics and the usefulness of that performance data. Historical subcontractor rates you have used before. Obtaining early teammate rough order of magnitude estimates. There are so many items that come into play about your company that you want to examine this data enough in advance to make the case for maintaining a database of the information.

Complexity Made Simple

While building a Strategic Pricing® plan is wide-ranging, if you take the components of the complex picture in their rightful prominence and step through, it will become routine. Data gathering is the entry into the big lake. Amass the data you need to make the right decisions and build your strategic pricing for each proposal.

- Significance of Data Gathering to Strategic Pricing® - September 2, 2024

- Government Contracting – To Bid or Not To Bid? - August 7, 2024

- Strategic Pricing® – Beyond Indirect Rates - May 13, 2024